Current Outlook Investing in Alternative Credit & Overview of Prime Meridian Capital Management

In this webinar, Prime Meridian Capital Management will discuss about investment opportunities in the alternative credit space. In particular, we will delve into the current outlook and considerations prior to investing in this asset class, numerous methods to invest and an overview of an early fund manager in this space, Prime Meridian Capital Management.

- Current Outlook Investing in Alternative Credit

- Key Considerations Before Investing

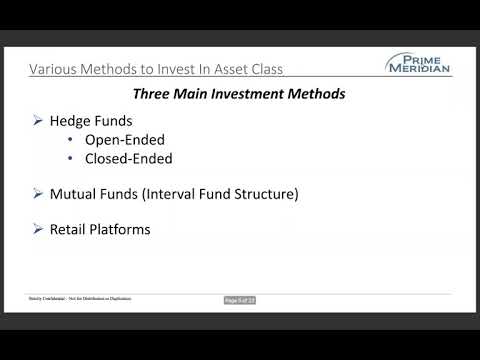

- Various Methods to Invest in the Asset Class

- Overview of Prime Meridian Capital Management

- Snapshot of Prime Meridian Funds

Event Recording

Current Outlook Investing in Alternative Credit & Overview of Prime Meridian Capital, Jeremy Todd

Speaker

Jeremy Todd

- Title

- Head of Capital Markets @

- Company

- Prime Meridian Capital Management

- Role

- Speaker

Jeremy Todd, CFA, has over 20 years of financial services experience in management, sales, and marketing covering asset managers, hedge funds, institutional investors, broker dealers, and registered investment advisors. He is the Head of Capital Markets at Prime Meridian Capital Management. Previously he was the Head of West Coast and Asia Regions at two different fintech startups dv01 and Orchard Platform. He also spent 17 years in prime brokerage starting at Montgomery Securities, then was a managing director at Bear Stearns, started the prime brokerage division at The Bank of New York Mellon, and lastly at Barclays managing the west coast business. Jeremy earned a B.A. in philosophy from the University of California, Berkeley.

About

Prime Meridian Capital Management

Since inception, our primary objective at Prime Meridian Capital Management has been to provide income diversification and long term relative value over traditional fixed income investments. The Prime Meridian funds have met this objective every year since inception and continue to do so. Our funds are increasingly popular with investors and asset management firms, and are approved for custody and distribution on major broker dealer (Fidelity, TDA, Pershing etc) and IRA/401k platforms. Offshore feeders are available for non-US investors, and approved at several popular international banks.